Cryptocurrencies have shaken the world of legacy finance, irrevocably changing it every day, and the world seems to welcome it. Cryptocurrency statistics point to virtual coins soaring in popularity, with thousands of cryptos available for buying and selling popping up over the last ten years.

Sure, the most popular crypto right now is still Bitcoin, the king of all cryptocurrencies, but it’s not the only game in town. There is so much more to crypto finance than what is going on with Bitcoin, and here are some interesting stats to prove it.

Top Cryptocurrency Stats: Editor’s Pick

- More than 40 million people use crypto.

- The crypto market will grow at a 30% CAGR by 2026.

- Dogecoin will probably be worth $1.087 by 2027.

- Hackers stole $1.9 billion in cryptocurrencies in 2020.

- Bitcoin consumes 129 TWh in power every year.

- Every month, over 300 developers join the Ethereum network.

- 3.7 million BTC is gone for good.

Cryptocurrency Awareness and Adoption Stats

1. Over 40 million people use cryptocurrency.

(Crypto Research)

Crypto is on its way up and fast. Adoption rates for many cryptos are booming as more and more people catch on to the convenience of virtual money. It’s now at a point where millions of people around the world use cryptocurrency on a daily basis.

For example, roughly 30 million people use Coinbase, a major crypto exchange. According to cryptocurrency adoption stats, it averages about 1 to 2 million users per day. Binance, alternatively, reports around 12 to 15 million users. While it’s expected that many users are registered on multiple exchanges, the estimates still show that crypto adoption is on the rise.

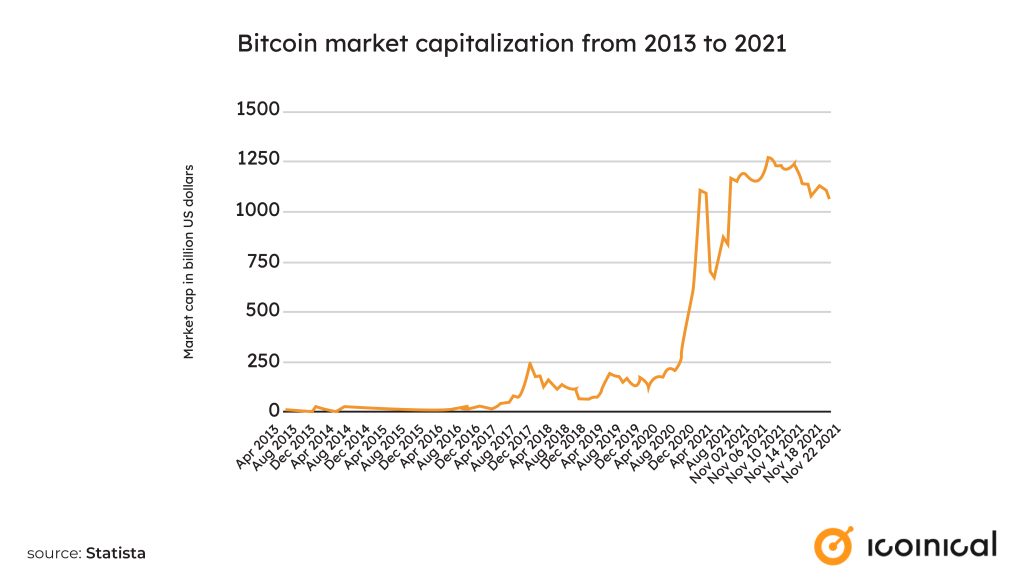

2. In January 2022, the crypto market cap was around $817 billion.

(Statista)

Back in 2013, the cryptocurrency market was worth around $1.5 billion. After a few years of relatively mild growth, the market exploded at the end of 2020. The peak of this expansion brought the highest cryptocurrency market cap ever recorded, according to statistics.

3. Coinbase generated $4.03 billion in Q1 of 2021.

(BusinessOfApps)

Coinbase is a platform where you can trade cryptocurrencies. It has around 50 cryptos available for buying and selling, such as Bitcoin, Ethereum, Litecoin, and others. Coinbase is one of the biggest brands in its niche, and it attracts millions of users every month.

Around 2.8 million people trade cryptos on Coinbase every month, as cryptocurrency usage statistics show. That kind of traffic is what allowed this platform to earn a revenue of $4.03 million in Q1 of 2021 alone.

4. By 2026, the cryptocurrency market will expand at a 30% CAGR.

(GlobeNewswire)

One of the biggest advantages that cryptocurrency offers is the absence of third-party authority. Not only does that significantly reduce any relevant red tape, but it also minimizes exchange and interest rates.

These perks are the main drivers for growth in the crypto market. As cryptocurrency growth statistics point out, the market size for cryptocurrency will reach a stunning $5.19 billion by 2026. The current big crypto names, such as Coinbase, Inc., Bitfinex, Financial Limited, Bitstamp, Ripple Labs, OKEx, Bitfury Group Limited, and Circle Internet, will still dominate the market.

5. As of mid-December 2021, US users received a total of $129.45 billion in cryptocurrency transactions.

(Crystal)

According to the latest cryptocurrency volume statistics, in the first quarter of 2021, the US was the recipient of $24.726 billion in blockchain transfers, while just $11.9 billion occurred outside the United States.

The US is among the biggest hubs for blockchain transfers. Not only is it the second-biggest recipient, but it’s also the second-biggest exporter of crypto transfers. China still reigns supreme as the strongest crypto nation, but as crypto gains more awareness worldwide, the tables are set to turn.

Crypto, Ethereum, Dogecoin, and Bitcoin Price Analysis

6. Bitcoin may be worth $1million by 2030.

(CoinDesk)

Generally speaking, Bitcoin’s price is on a constant uptrend. If we zoom out its charts, we can see that it’s slowly advancing towards the $1 million milestone that many analysts predict. However, considering its current trend downwards, we might have to wait for another post-halving period to see Bitcoin’s value hitting $1 million.

7. NEM’s highest ever value was $0.184.

(Coinmarketcap)

Similar to Ethereum, NEM (New Economy Movement) isn’t just a currency. Rather, it’s more of a platform for cheaper, more efficient data and asset management. It was created in 2015 as a fork of NXT.

Many have likened NEM to Ethereum because of its function. Value-wise, however, the NEM vs. Ethereum battle is still in the latter’s favor. Since ETH is the second-most valuable crypto on the market, NEM is far behind in that sense.

8. According to some predictions, Dogecoin might be worth $1.087 by 2027.

(Wallet Investor)

Dogecoin is a peculiar case of a parody turning into what it was initially mocking. This “meme money” started out as a joke deriding the crypto craze at the time. People soon stopped laughing, though, when it began gaining serious traction.

This crypto is now among the hottest on the market. Dogecoin price prediction is optimistic for the most part, and some claim the crypto will reach the $1 benchmark in May 2026. At the moment of writing, it’s the tenth most valuable cryptocurrency.

9. Someone who invested in Bitcoin in October 2010 would enjoy an ROI of 48,000,000% in February 2021.

(CNBC)

Even people who have nothing to do with Bitcoin know it’s worth a lot of money. Naturally, it wasn’t worth nearly as much right off the gate. For example, a single BTC was only worth 10 cents in October 2010.

During its ascension to the status of best cryptocurrency in terms of value, Bitcoin’s price increased tremendously. For the few who held onto their coins, congratulations.

10. With a value of $0.000001 in May 2021, Compound Coin was one of the least valuable crypto coins at the moment.

(Yahoo! Finance)

Compound Coin (COMP1) stands out as one of the coins with the lowest value in 2021. It isn’t the smallest in terms of circulating supply, though, with 53.7 billion coins available.

Compound Coin runs on the Ethereum blockchain, and it’s used as currency for the Compound network. Compound is a money market platform that facilitates loans in various cryptocurrencies.

Cryptocurrency Statistics: Cryptocrime

11. In 2020, hackers stole $1.9 billion in cryptocurrencies.

(Security)

The year 2020 saw the crypto market swell. Unfortunately, this growth also came with more opportunities for hackers to do their thing.

While the loss was substantial, the cost of crypto hacking in 2020 was actually an improvement compared to the year before. The year 2019 was a hotbed for cryptocurrency hacking, as statistics show, with $4.5 billion stolen in crypto.

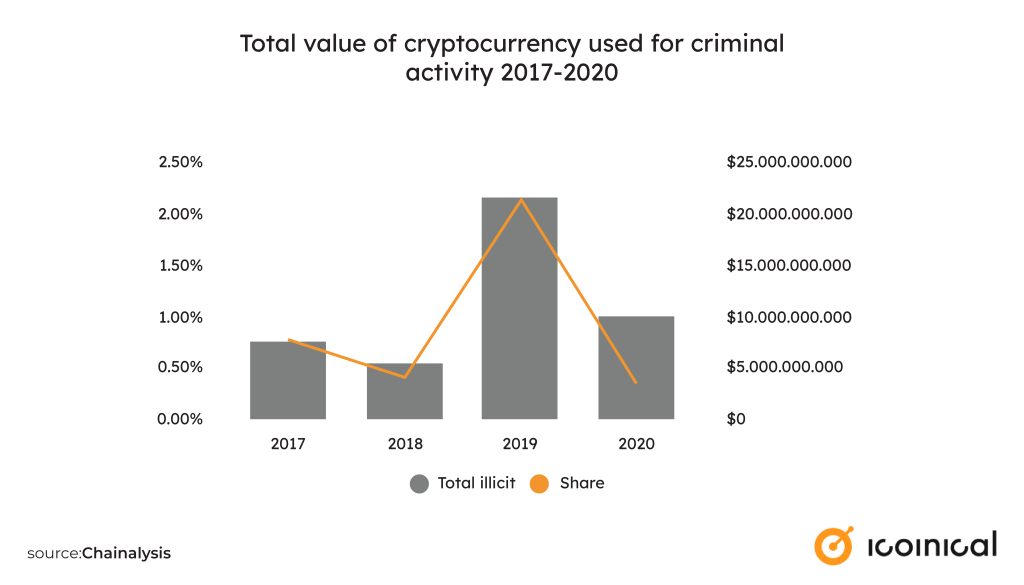

12. Over $10 billion in cryptos were used for criminal activities in 2019.

(Chainalysis)

Cryptocurrency receives praise for a variety of reasons, but just as much, people question its legitimacy. Among the main points of criticism is that crypto is a criminal’s dream currency. In 2019, over $10 billion of crypto was used for criminal activity. Still, that’s only 2.1% of all crypto transfers.

13. In January 2018, North Korean hackers stole $534 million from Coincheck.

(UPI)

The Coincheck heist remains one of the biggest cases recorded in cryptocurrency theft statistics.

The victim of the sting was the Japanese exchange Coincheck. Hackers affiliated with North Korea managed to steal millions of dollars in NEM. Notably, data suggests that North Korea has had involvement in five of the ten biggest crypto thefts in history.

14. Bitcoin’s annual power consumption is 129 TWh.

(Visual Capitalist)

Another point of concern with using Bitcoin is its gigantic energy output. Most of the energy that Bitcoin consumes comes from mining, an integral part of how it works.

Cryptocurrency power consumption statistics show just how large Bitcoin’s energy demand is. If it were a country, Bitcoin would rank 29th in terms of energy consumption, ranking just above Bangladesh or Argentina.

15. The number of reported cryptojacking cases increased by 28% in 2020.

(SonicWall)

Cryptojacking involves sending malware that makes the infected computer mine a cryptocurrency, and of course, the hacker gets all the coins rewarded for the mining.

Alarmingly, cryptocurrency security statistics warn there were considerably more reports of cryptojacking in 2020. Another concern was the 62% increase in crypto ransomware attacks. Cybersecurity stats bring some good news at least—the number of malware attacks in 2020 went down by 43%.

16. Over 30% of cross-border Bitcoin volume goes to exchanges with poor KYC.

(CipherTrace)

An immense amount of cross-border Bitcoin transfers concluded in 2020 with minimal KYC procedures. On the other hand, US VASP transfers were much more rigorously monitored. Notably, cryptocurrency statistics show that 98% of these transfers had strong KYC procedures. That said, around 24% of outbound transfers involved bad KYC processes.

Looking at the 2020 Bitcoin inflows and outflows, it’s evident that they made up a huge chunk of the global Virtual Asset Service Provider volume. Notably, Bitcoin made up approximately 85% of the overall VASP volume for the year.

Other Cryptocurrency Market Statistics and Intriguing Data

17. More than 300 developers join the Ethereum network every month.

(Medium)

Data suggests that Ethereum has more developers than any other crypto, and this number is growing at a rapid rate, with hundreds joining this relatively new platform.

Ethereum isn’t the only crypto experiencing growth lately. It seems to be a part of an overall expansion of the crypto market. For example, cryptocurrency developer statistics indicate that the number of Bitcoin developers has grown by over 70% compared to the last three years.

18. In May 2021, Ethereum’s market cap was roughly 43% of Bitcoin’s.

(Yahoo! Finance)

Ethereum may have a smaller market cap than Bitcoin, but it has been growing much faster. In the first five months of 2021, Ethereum grew in value by a staggering 434%. Ethereum still has plenty of ground to cover, though.

Admittedly, this Ethereum vs. Bitcoin price rivalry doesn’t really do justice to either crypto. Both have their purposes and strengths, so a difference in value doesn’t say much about their overall worth.

19. In March 2021, BitPay was the platform for 27.18% of all crypto payments.

(BitPay)

BitPay is one of the largest bitcoin payment service providers out there. You can use it to pay merchants with Bitcoin, Bitcoin Cash, or other cryptocurrencies.

We can get a glimpse of BitPay’s size by examining its cryptocurrency transaction stats. It processes 68,774 blockchain payments every month on average. Bitcoin is involved in around 70% of these transactions.

20. Binance has an estimated 27,657,536 weekly visitors.

(Coinmarketcap)

In terms of visitors, Binance is by far the biggest crypto exchange on the market. It has around 8 million more weekly visitors than eToro, the second-largest exchange by this metric. It also has way more daily transaction volume than its competitors, at around $37 billion.

Binance isn’t superior in every way, however. For example, cryptocurrency exchange stats note that it has 364 different coins available for trade. Compared to an exchange like Hotbit, which offers 768 tradeable coins, that isn’t quite as impressive. Binance is also available in 1,242 markets, making it the third-most available exchange.

21. 3.7 million BTC are lost forever.

(Currency)

Human error is inescapable, and the crypto industry is no exception. Unfortunately, everyday fumbles are very costly in the Bitcoin sphere.

In what may be the most depressing of all cryptocurrency stats, around 1,500 BTC is lost forever every day on average. Since approximately 900 BTC are mined daily, this is especially concerning. When translated into fiat money, that’s $56.2 million lost every day, based on the BTC value from January 2022.

Conclusion

Cryptocurrency is just one aspect of the digital revolution that predicts to change the way we think about and use money. The introduction of a completely virtual currency was unprecedented even 15 years ago.

Bitcoin isn’t the only player anymore, and some of the best stats about cryptocurrency show that thousands of other cryptocurrencies serve their own particular purpose. They may not have rivaled the BTC legacy as of yet, but many platforms are working towards creating currencies to help better manage business transactions and legal processes.

There’s still a lot of skepticism and worrisome issues like hacking and criminal investments to cover. Entering the new decade, however, it truly seems that crypto is here to stay.

Frequently Asked Questions

In no particular order, these are the ten biggest cryptocurrencies:

- Ethereum

- USD Coin

- Cardano

- Solana

- Bitcoin

- Ripple

- Terra

- Dogecoin

- Binance Coin

- Tether

They all have their strengths and faults, so personal preference will largely dictate which ones will be to your liking. With that in mind, Bitcoin and Ethereum are the ones worth the most at the moment. If pure monetary value is your priority, these two should be high on your to-get list.

Some data suggests that Seychelles is the biggest cryptocurrency buyer. This country has received a total of $116.375 billion in blockchain transfers. It sent even more, though, a total of $147.448 billion.

Notably, the United States has the most Bitcoin owners and the biggest BTC trading volume. Meanwhile, the US has received $83.146 billion in blockchain transactions in total.

The most commonly traded cryptocurrencies on the market right now are:

- USD Coin

- Tether

- Bitcoin

- Ethereum

- Bitcoin Cash

Every one of these popular cryptos has its own advantages that make them stand out. For example, Bitcoin has a sort of prestige as the first popular cryptocurrency (as well as its high value). Meanwhile, Ethereum has many intriguing applications such as smart contracts and dapp development.

Judging by the criterion of per-coin price, Bitcoin is one of the most valuable crypto coins right now. At the moment of writing, a single BTC is worth nearly $38,000. Currently, Bitcoin is also the coin with the biggest market cap, at around $711 billion.

Though its value has been quickly prone to change, Bitcoin has consistently been the most valuable coin without question. The odds of any other crypto overtaking it in the near future are slim.

It’s exceedingly difficult to say whether or not crypto is a good investment. Plenty of cryptocurrencies (such as Bitcoin) have been extremely profitable in the long run, despite the occasional dramatic dip in value. That being said, many haven’t shown any return on investment.

Cryptocurrency is a risky investment compared to other more established stocks, but that isn’t to say it’s not worth taking a chance on.

There are a few cryptocurrencies that are primed to rise sharply in value. These are:

- Ethereum

- Dogecoin

- Cardano

- Ripple

- Binance Coin

- Bitcoin

- Chainlink

- Uniswap

- Polkadot

- Solana

The outlook for all these cryptocurrencies is positive, but no prediction is a guarantee you could earn a fortune trading them.

Technically, Satoshi Nakamoto is the richest Bitcoin owner, who has almost $39 billion in BTC. The problem is that we don’t know who Satoshi is or if it’s a pseudonym for multiple people. If we exclude Satoshi, Micree Zhan is the richest Bitcoin owner. His overall Bitcoin hoard is $3.2 billion. According to cryptocurrency statistics, Chris Larsen is the next in line, sporting a Bitcoin wealth of $2.7 billion.